UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

ATLAS ENERGY, L.P.

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

ATLAS ENERGY, L.P.

Park Place Corporate Center One

1000 Commerce Drive, 4th Floor

Pittsburgh, PA 15275

NOTICE OF ANNUAL MEETING OF UNITHOLDERSAND PROXY STATEMENT

To be held on Thursday, April 25, 2013March 21, 2014

To the Unitholders of ATLAS ENERGY, L.P.:

Notice is hereby given that theThe annual meeting of unitholders of ATLAS ENERGY, L.P., a Delaware limited partnership, will be held on Wednesday, April 23, 2014 at Sofitel Philadelphia, 120 South 17th8:30 a.m. at The Worthington Renaissance Fort Worth Hotel, 200 Main Street, Philadelphia, Pennsylvania 19103, April 25, 2013, at 9:00 a.m. (the “Meeting”), for the following purposes:Fort Worth, Texas to:

| 1. |

| 2. |

| 3. |

| 4. |

OnlyWe cordially invite all of our unitholders to attend the meeting, though only unitholders of record on our books at the close of business on March 22, 2013,14, 2014 will be entitled to notice of and to vote at the Meeting or any adjournment thereof.vote. A list of unitholders entitled to vote at the Meetingmeeting will be available for inspection at the Meetingmeeting and for 10 days before the Meetingmeeting at our offices at Park Place Corporate Center One, 1000 Commerce Drive, 4th Floor, Pittsburgh, Pennsylvania 15275. The unit transfer books will not be closed.

THE ENCLOSED ADDRESSED ENVELOPE FOR RETURNING THE ENCLOSED PROXY REQUIRES NO POSTAGE AND YOU MAY REVOKE YOUR PROXY AT ANY TIME BEFORE ITS USE. IF YOU PLAN TO ATTEND THE MEETING, YOU NEED TO BRING A FORM OF PERSONAL IDENTIFICATION WITH YOU. IF YOUR UNITS ARE HELD OF RECORD BY A BANK, BROKER OR OTHER NOMINEE, YOU ALSO NEED TO BRING AN ACCOUNT STATEMENT INDICATING THAT YOU BENEFICIALLY OWN THE UNITS AS OF THE RECORD DATE, OR A LETTER FROM THE RECORD HOLDER INDICATING THAT YOU BENEFICIALLY OWN THE UNITS AS OF THE RECORD DATE, AND IF YOU WISH TO VOTE AT THE MEETING YOU MUST FIRST OBTAIN FROM THE RECORD HOLDER A PROXY ISSUED IN YOUR NAME.

By order of the Board of Directors of the General Partner,

Lisa Washington, Secretary of

Atlas Energy GP, LLC, the general partner of

Atlas Energy, L.P.

March 27, 201321, 2014

Important Notice Regarding the Availability of Proxy Materials for

the Meeting to be held on Wednesday, April 25, 2013:23, 2014:

The proxy statement and our 20122013 Annual Report are available at:

http://phx.corporate-ir.net/phoenix.zhtml?c=197317&p=irol-reportsAnnual

ATLAS ENERGY, L.P.2014 Proxy Statement—Summary

Park Place Corporate Center One

1000 Commerce Drive, 4th Floor

Pittsburgh, PA 15275This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information you should consider. You should read the entire proxy statement carefully before voting.

GENERAL INFORMATION (see pages 3-5) | CORPORATE GOVERNANCE (see pages 7-13; 15-19) | |

Meeting: Annual Meeting of Unitholders Date: Wednesday, April 23, 2014 Time: 8:30 a.m. Location: The Worthington Renaissance Fort Worth Hotel, 200 Main Street, Fort Worth, Texas 76102-3011 Record date: March 14, 2014 Stock symbol: ATLS Exchange: NYSE Common units outstanding: 51,464,243 Transfer agent: American Stock Transfer & Trust Company State of formation: Delaware Headquarters: Park Place Corporate Center One, 1000 Commerce Drive, 4thfloor, Pittsburgh, Pennsylvania 15275 Website:www.atlasenergy.com Annual report:http://phx.corporate- ir.net/phoenix.zhtml?c=197317&p=irol- reportsAnnual | Director nominees: 2 • Edward E. Cohen (Management) (CEO and President) • Ellen F. Warren (Independent) Board term: 3 years Director election standard: Plurality of votes cast Board meetings in 2013: 12 Standing board committees (Meetings in 2013): Audit (10), Nominating and Governance (4), Compensation Committee (10), Investment (3) Corporate governance materials: http://phx.corporate- ir.net/phoenix.zhtml?c=197317&p=irol-reports Board communications: You may contact the chairman of the Audit Committee, Mark C. Biderman. Correspondence to Mr. Biderman should be marked “Confidential” and sent to Mr. Biderman’s attention, c/o Atlas Energy, L.P., 1845 Walnut Street, 10th Floor, Philadelphia, PA 19103 | |

EXECUTIVE COMPENSATION (see pages 20-47) | OTHER ITEMSTOBE VOTEDON (see pages 13-15) | |

CEO and President: Edward E. Cohen (age 75; CEO since February 2011) Base salary: $1,000,000 | • Advisory vote to approve named executive officer compensation • Ratification of appointment of independent registered public accounting firm(Grant Thornton LLP) | |

Annual incentive bonus: $1,200,000 cash/$4,800,000 ATLS phantom units Long-term incentives: $1,500,000 Atlas Pipeline Partners, L.P.’s (“APL”) phantom units |

Compensation highlights: • Moved annual incentive compensation from largely cash-based bonus system to substantially equity-based bonus system • Adopted clawback policy • Adopted stock ownership guidelines Hedging policy: Yes Tax gross ups: No |

PROXY STATEMENT2013 PERFORMANCE OVERVIEW

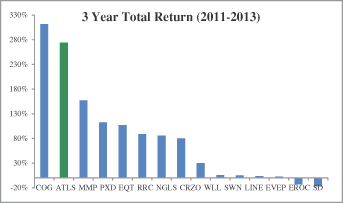

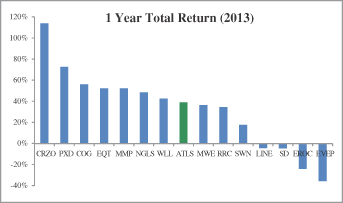

ANNUAL MEETING OF UNITHOLDERS2013 was another successful year for our company. We achieved high returns in our common unit price and distributions to our unitholders. Our three-year total unitholder return is 274% and our 2013 total unitholder return is 39%. The following charts depict our total unitholder returns as compared to our oil and gas industry peer group (see “Compensation Discussion and Analysis—Governance of Executive Compensation—Independent Compensation Consultant” for a description of the peer group):

Other highlights of company performance in 2013 include:

| • | In an industry that strives to maintain constant levels of reserves of hydrocarbons, a declining asset, our proved reserves increased by approximately 52%. |

2

| • | We acquired over 600,000 net undeveloped acres of energy rights (an increase of almost 200%) and over 340,000 net developed acres (an increase of 95%). In addition, we added approximately 1,500 potential drilling locations, more than doubling the 1,200 sites held at the beginning of the year. |

Our natural gas production increased by 97%, and our processed volumes at APL increased by approximately 80%.

GENERALGeneral Information

TERMS USED

References in this proxy statement to “theto:

“the Partnership,” “we,” “our,” “us” or like terms refer to Atlas Energy, L.P. and its subsidiaries. References in this proxy statement to subsidiaries;

the “General Partner” refer to Atlas Energy GP, LLC, our general partner and our wholly-owned subsidiary. References in this proxy statement to subsidiary;

the “Board” refer to the Board of Directors of our General Partner. References in this proxy statement to Partner;

the “Partnership Agreement” refer to our Second Amended and Restated Agreement of Limited Partnership dated as of February 17, 2011, as amended by Amendment No. 1 dated as of February 18, 2011 and Amendment No. 2 dated as of December 12, 2011. References in this proxy statement to “common2011;

“common units” refer to our common units representing limited partner interests in the Partnership. References in this proxy statement to “unitholders”interests;

“unitholders” or “limited partners” refer to limited partners owning our common units.units; and

the “Meeting” refers to the annual meeting of unitholders of Atlas Energy, L.P. to be held on Wednesday, April 23, 2014.

IntroductionTHE MEETING; THIS PROXY STATEMENT

The annual meeting of unitholders of Atlas Energy, L.P. will be held on Thursday,Wednesday, April 25, 201323, 2014 at 9:008:30 a.m. (the “Meeting”) at Sofitel Philadelphia, 120 South 17thThe Worthington Renaissance Fort Worth Hotel, 200 Main Street, Philadelphia, Pennsylvania 19103,Fort Worth, Texas, for the purposes set forth in the accompanying notice. Only unitholdersUnitholders of record at the close of business on March 22, 2013 will be14, 2014 are entitled to notice of and to vote at the Meeting and any adjournments of the Meeting.

This proxy statement is furnished in connection with the solicitation by the Board of proxies from holders of our common units to be used at the Meeting, and at any and all adjournments thereof.of the Meeting. Proxies in the accompanying form, properly executed and returned to us, and not revoked, will be voted at the Meeting and any and all adjournments thereof.adjournments.

This proxy statement and the accompanying form of proxy are being sent on or about March 27, 2013,21, 2014, to unitholders of record as of March 22, 2013.14, 2014.

Changing or Revoking ProxyCHANGINGOR REVOKING PROXY

If a proxy in the accompanying form is executed and returned, it may nevertheless be revoked at any time before its use by giving written notice of revocation to our Secretary at our Pittsburgh address stated herein, by submitting a later dated proxy or by attending the Meeting and voting in person.

Common Units Outstanding and Entitled to Vote at the MeetingCOMMON UNITS OUTSTANDINGAND ENTITLEDTO VOTEATTHE MEETING

There were 51,370,56051,464,243 common units outstanding as of the March 22, 201314, 2014 record date. Each of those common units is entitled to one vote on each matter to be voted on at the Meeting.

If you own your common units indirectly through a broker or other holder of record, those units are held in “street name.” If your common units are held in street name, you are not a holder of record of those units and

3

cannot vote them at the Meeting unless you have a legal proxy from the holder of record. If you plan to attend and vote your street-name units at the Meeting, you should request a legal proxy from your broker or other holder of record and bring it with you to the Meeting.

QuorumQUORUM

The presence in person or by proxy of holders of our outstanding common units representing not less than a majority of the outstanding common units will constitute a quorum. We will also treat as present for quorum purposes abstentions and common units held in street name that are represented by proxies at the Meeting, but that the broker fails to vote on one or more matters as a result of incomplete instructions from the beneficial owner of the common units.

Vote Required; Effect of Abstentions and Broker Non-VotesVOTE REQUIRED; EFFECTOF ABSTENTIONSAND BROKER NON-VOTES

Election of Directors.The affirmative vote of a plurality of the votes cast at the Meeting is required for the election of directors. A properly submitted proxy to “Withhold Authority” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether or not there is a quorum.

Say on PayPay.. The proposal regarding Say on Pay is advisory and not binding on the Board or the Partnership. With respect to this proposal, the affirmative vote of the holders of a majority of the outstanding units entitled to vote and represented in person or by proxy will constitute the unitholders’ non-binding approval of this proposal.

Ratification of the selectionSelection of our independent registered public accounting firmIndependent Registered Public Accounting Firm.. The approval of the ratification of our independent registered public accountants for 20132014 requires an affirmative vote of the holders of a majority of the outstanding units entitled to vote and represented in person or by proxy.

Other ProposalsProposals.. For each other item, the affirmative vote (or a “FOR” vote) of the holders of a majority of the outstanding units entitled to vote and represented in person or by proxy with regard to such item will be required for approval.

A properly submitted proxy to “ABSTAIN” with respect to any such matter will not be voted, although it will be counted for purposes of determining the number of common units present and entitled to vote at the Meeting. For any matter requiring approval of a majority of the outstanding common units entitled to vote and represented in person or by proxy, an abstention will have the effect of a negative vote.

Under New York Stock Exchange (“NYSE”) rules, each of the above proposals, other than the ratification of the selection of ourthe independent registered public accounting firm, is considered a “non-routine” matter.This means that if you do not directly vote your units and you do not give your broker or nominee specific instructions as to how to vote your units, your broker or nominee does not have authority to vote your units with respect to such matters and your units will not be voted on such matters.The ratification of the selection of our independent registered public accounting firm is considered a “routine” matter under NYSE rules andrules; if you do not give your broker or nominee specific instructions as to how to vote your units, your broker has authority to vote those units for or against such matter.

Recommendations of our Board of DirectorsRECOMMENDATIONSOFOUR BOARDOF DIRECTORS

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board. The recommendations of the Board are set forth together with the description of each item in this proxy statement. In summary, the Board recommends a vote:

FOR election of the threetwo nominees to the Board;

FOR the non-binding resolution approving the compensation of our Named Executive Officers (“Say on Pay”); and

4

FOR ratification of the Audit Committee’s appointment of Grant Thornton LLP as our independent registered public accounting firm for the 20132014 fiscal year.

2

With respect to any other matter that properly comes before the Meeting, it is the intention of the persons named as proxies to vote upon them in accordance with their best judgment of what they consider to be in our best interests.

Expenses and Manner of SolicitationEXPENSESAND MANNEROF SOLICITATION

We will bear the cost of soliciting proxies for the Meeting, including the cost of preparing, assembling and mailing this proxy statement and the accompanying form of proxy. Our directors, officers and employees may solicit proxies personally or by letter or telephone, but no director, officer, or employee will be specially compensated for soliciting such proxies. We expect to reimburse banks, brokers and other persons for their reasonable out-of-pocket expenses in handling proxy materials for beneficial owners of our common units.

No Appraisal RightsNO APPRAISAL RIGHTS

Unitholders who object to the proposals will not have appraisal, dissenters’ or similar rights under Delaware law.

35

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENTSecurity Ownership of Certain

Beneficial Owners and Management

The following table sets forth the number and percentage of common units owned, as of March 22, 2013,6, 2014, by (a) each person who, to our knowledge, is the beneficial owner of more than 5% of the outstanding common units, (b) each of our present directors and nominees, (c) each of our executive officers serving during the 20122013 fiscal year, and (d) all of our directors, nominees and executive officers as a group. This information is reported in accordance with the beneficial ownership rules of the Securities and Exchange Commission under which a person is deemed to be the beneficial owner of a security if that person has or shares voting power or investment power with respect to such security or has the right to acquire such ownership within 60 days. Common units issuable pursuant to options or warrants are deemed to be outstanding for purposes of computing the percentage of the person or group holding such options or warrants but are not deemed to be outstanding for purposes of computing the percentage of any other person. Unless otherwise indicated in footnotes to the table, each person listed has sole voting and dispositive power with respect to the securities owned by such person.

Common unit amount and nature of beneficial ownership | Percent of class | |||||||||

Beneficial owner | ||||||||||

Directors(1) | ||||||||||

Carlton M. Arrendell | * | |||||||||

Mark C. Biderman | * | |||||||||

Edward E. Cohen | (2)(4) | % | ||||||||

Jonathan Z. Cohen | (3)(4) | % | ||||||||

Dennis A. Holtz | * | |||||||||

| * | |||||||||

| * | |||||||||

Ellen F. Warren | * | |||||||||

Non-director principal officers(1) | ||||||||||

Eugene N. Dubay | (5) | * | ||||||||

Freddie M. Kotek | (6) | * | ||||||||

Matthew A. Jones | (4) | * | ||||||||

Daniel C. Herz | 146,783 | * | ||||||||

Sean P. McGrath | (4) | * | ||||||||

Jeffrey M. Slotterback | * | |||||||||

Lisa Washington | (4) | * | ||||||||

All executive officers, directors and nominees as a group (15 persons) | (7) | % | ||||||||

Other owners of more than 5% of outstanding common units | ||||||||||

Leon G. Cooperman | (8) | |||||||||

| % | |||||||||

ING Groep N.V./ING Capital Markets LLC | % | |||||||||

| * | Less than 1% |

| (1) | The business address for each director, director nominee and executive officer is Park Place Corporate Center One, 1000 Commerce Drive, 4th Floor, Pittsburgh, PA 15275-1011. |

| (2) | Includes (i) 26,251 common units held in an individual retirement account of Mr. E. Cohen’s spouse, (ii) |

| (3) | Includes (i) 67,273 common units held in a trust of which Mr. J. Cohen is a co-trustee and co-beneficiary and (ii) |

6

| sibling serve as co-trustees. These common units are also included in the common units referred to in footnote 2 above. Mr. J. Cohen disclaims beneficial ownership of the above referenced common units. |

4

| (4) | Includes common units issuable on exercise of options granted under our Plans in the following amounts: Mr. E. |

| (5) | Includes 620 common units held in trust for the benefit of Mr. Dubay’s spouse. |

| (6) | Includes (i) 2,731 common units held by spouse, (ii) |

| (7) | This number has been adjusted to exclude 67,273 common units and |

| (8) | This information is based on a Schedule 13G/A filed with the SEC on February |

| (9) | This information is based on a Schedule 13G/A filed with the SEC on February 14, |

PROPOSALProposal 1: ELECTION OF DIRECTORSElection of Directors

DIRECTOR NOMINATION PROCESS

The Nominating and Governance Committee of the Board identifies director nominees by first evaluating the current members of the Board willing to continue in service. Current members with skills and experience that are relevant to our business and are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective. If any member of the Board does not wish to continue in service, or if the Nominating and Governance Committee or Board decides not to nominate a member for re-election, or if we decide to expand the Board, the Nominating and Governance Committee identifies the desired skills and experience of a new nominee consistent with the Nominating and Governance Committee’s criteria for Board service. Current members of the Board and management are polled for their recommendations. Research may also be performed or third parties retained to identify qualified individuals. To date, we have not engaged third parties to identify or evaluate potential nominees; however, we may in the future choose to do so.

The Nominating and Governance Committee has not adopted a formal policy with regard to the consideration of diversity in identifying director nominees. The Nominating and Governance Committee evaluates independent director candidates based upon a number of criteria, including:

commitment to promoting the long-term interests of our unitholders and independence from any particular constituency;

professional and personal reputations that are consistent with our values;

broad general business experience and acumen, which may include experience in management, finance, marketing and accounting;

a high level of personal and professional integrity;

adequate time to devote attention to the Board;

such other attributes, including independence, relevant in constituting a board that also satisfies the requirements imposed by the SEC and the NYSE; and

board balance in light of our current and anticipated needs and the attributes of the other directors and executives.

7

The Nominating and Governance Committee does not anticipate that it would evaluate director nominees recommended by a unitholder differently. For additional information about unitholder nominations, see “Unitholder Proposals or Director Nominations.”

NOMINEES

Proposal 1 is to elect the following persons to serve as our Class IIIII directors: Carlton M. Arrendell, Mark C. BidermanEdward E. Cohen and Jonathan Z. Cohen.Ellen F. Warren. Since no other nominations were timely made, no other nominees will be considered at the Meeting. The Board is divided into three classes with directors in each class serving three-year terms. The terms of directors in Class IIIII expire at the Meeting.

The persons named in the enclosed proxy intend, in the absence of a contrary direction, to vote for Messrs. Arrendell, BidermanMr. Cohen and J. Cohen as Class II directorsMs. Warren to serve for three-year terms expiring at the 20162017 annual meeting, or until their successors are elected or appointed. Should any nominee become unable or refuse to accept nomination or election as a Class II director, it is intended that the persons named as proxies will vote for the election of such other person as the Board may recommend. The Board knows of no reason why any nominee might be unable or refuse to accept nomination or election.

Information is set forth below regarding the principal occupation of each nominee and each of our other directors. There are no family relationships among the nominees and directors, except that Edward E. Cohen, Chief Executive Officer, President and Director, is the father of Jonathan Z. Cohen, Executive Chairman of the Board.

The Board unanimously recommends a vote “FOR” each of the nominees as Class III directors named in Proposal 1.

Nominees for Election for a Three-Year Term Expiring at the 2016 Annual Meeting:

Carlton M. Arrendell, 51, has served as a director since February 2011. Mr. Arrendell has been the Chief Investment Officer and a Vice President of Full Spectrum of NY LLC since May 2007. Prior to joining Full Spectrum, Mr. Arrendell served as a special consultant to the AFL-CIO Investment Trust Corporation following six years of service as Investment Trust Corporation’s Chief Investment Officer. Mr. Arrendell is a seasoned energy company director having previously served as a director of Atlas Energy, Inc. from February 2004 until February 2011 as well as the chair of its audit committee from 2004 to 2009. He is also an attorney admitted to practice law in Maryland and the District of Columbia. As a member of the National Association of Corporate Directors and a result of his legal background, Mr. Arrendell offers expertise in corporate governance matters. Mr. Arrendell brings over 25 years of business experience to the Board and his investment expertise is valuable to the Partnership andEdward E. Cohen, our subsidiaries in evaluating acquisitions being pursued. In addition, the Board benefits from his strong background in finance.

5

Mark C. Biderman, 67, has served as a director since February 2011. Before that, he was a director of Atlas Energy, Inc. from July 2009 until February 2011. Mr. Biderman was Vice Chair of National Financial Partners Corp. (a publicly-traded financial services company) from September 2008 to December 2008. Before that, from November 1999 to September 2008, he was National Financial’s Executive Vice President and Chief Financial Officer. From May 1987 to October 1999, he served as Managing Director and Head of the Financial Institutions Group at CIBC World Markets Group (an investment banking firm) and its predecessor, Oppenheimer & Co., Inc. Mr. Biderman serves as a director and chair of the audit committee of Full Circle Capital Corporation (a publicly-traded investment company), as well as a member of its corporate governance and nominating committee, since August 2010. Mr. Biderman serves as a director, and chair of the compensation committee of Apollo Commercial Real Estate Finance, Inc. (a publicly-traded commercial real estate finance company) as well as a member of its audit committee, since November 2010. He also serves as a director and chair of the audit committee and as a member of the nominating and corporate governance committee of Apollo Residential Mortgage, Inc. (a publicly-traded residential real estate finance company and an affiliate of Apollo Commercial Real Estate Finance, Inc.) since July 2011. Mr. Biderman is a Chartered Financial Analyst. Mr. Biderman brings extensive financial expertise to the Board as well as to the Audit Committee. Mr. Biderman brings over 40 years of business and financial experience to the Board, including his service as a chief financial officer for over eight years. Mr. Biderman also brings more than seven years of collective service on various boards of directors as well as his service on the audit committees of three other companies. In addition, the Board benefits from his business acumen and valuable financial experience.

Jonathan Z. Cohen, 42, has served as the Executive Chair of the Board of our general partner since January 2012. Before that, he served as Chair of the Board of our general partner from February 2011 until January 2012 and as Vice Chair of the Board of our general partner from its formation in January 2006 until February 2011. Mr. Cohen has served as chair of the executive committee of our general partner since 2006. Mr. Cohen was the Vice Chair of the Board of Atlas Energy, Inc. from its incorporation in September 2000 until the consummation of the Chevron Merger in February 2011. Mr. Cohen has been the Executive Vice Chair of the managing board of Atlas Pipeline Partners GP, LLC (“Atlas Pipeline GP”) since its formation in 1999 and Vice Chair of the board of Atlas Resource Partners GP, LLC (“Atlas Resource GP”) since February 2012, both of which are our wholly-owned subsidiaries. Mr. Cohen was the Vice Chair of the board of Atlas Energy Resources, LLC and its manager, Atlas Energy Management, Inc. from their formation in June 2006 until the consummation of the Chevron Merger in February 2011. Mr. Cohen has been a senior officer of Resource America, Inc. (a publicly-traded specialized asset management company) since 1998, serving as the Chief Executive Officer since 2004,and President since 2003 and a director since 2002. Mr. Cohen has been Chief Executive Officer, President and a director of Resource Capital Corp. (a real estate investment trust that is externally managed by Resource America, Inc.) since its formation in 2005. Mr. Cohen is a son of Edward E. Cohen.

Mr. Cohen’s extensivestrong financial and energy industry experience, along with his deep knowledge of the Partnershipour company resulting from his long length of servicetenure with the Partnershipus and itsour predecessors, as well as his strong financial and industry experience, allow himenables Mr. Cohen to contributeprovide valuable perspectives on many issues facing the Partnership.our company. Mr. Cohen’s service on the Board creates an important link between management and the Board and provides the Partnershipour company with decisive and effective leadership. Mr. Cohen’s involvement withextensive experience in founding, operating and managing public and private entitiescompanies of varying size and complexity and focus and raising debt and equity for such entities providesenables him with extensive experience and contacts that areto provide valuable expertise to the Partnership.our company. Additionally, among the reasons for his appointment as a director, Mr. Cohen’s financial, business, operational and energy experience as well asCohen brings to the Board the vast experience that he has accumulated through his activities as a financier, investor and investor, add strategic vision to our Board to assist with our growth, operations and development.operator in various parts of the country. These diverse experiences have enabled Mr. Cohen is able to draw upon these diverse experiencesbring unique perspectives to provide guidance and leadershipthe Board, particularly with respect to exploration and production operations, capitalbusiness management, financial markets and corporate financefinancing transactions and corporate governance issues.

Continuing Directors to Serve until the 2014 Annual Meeting:

Edward E.Mr. Cohen, 74,75, has served as our Chief Executive Officer and President since February 2011. Mr. Cohen was the Chair of the Board of our general partnerGeneral Partner from its formation in January 2006 until February 2011. Mr. Cohen served as the Chief Executive Officer of our general partnerGeneral Partner from its formation in January 2006

6

until February 2009. Mr. Cohen has served on the executive committee of our general partnerGeneral Partner since 2006. Mr. Cohen also was the Chair of the Board and Chief Executive Officer of Atlas Energy, Inc. (formerly known as Atlas America, Inc.) from its organization in 2000 until the consummation of the Chevron Merger in February 2011 (the “Chevron Merger”) and also served as its President from September 2000 to October 2009. Mr. Cohen has been the Executive Chair of the managing board of Atlas Pipeline Partners GP, our wholly-owned subsidiary,LLC (“Atlas Pipeline GP”), since its formation in 1999. Mr. Cohen was the Chief Executive Officer of Atlas Pipeline GP from 1999 to January 2009. Mr. Cohen has served as Chair of the board and Chief Executive Officer of Atlas Resource Partners GP, our wholly-owned subsidiary,LLC (“Atlas Resource GP”) since February 2012. Mr. Cohen was the Chair of the Board and Chief Executive Officer of Atlas Energy Resources, LLC and its manager, Atlas Energy Management, Inc. from their formation in June 2006 until the consummation of the Chevron Merger in February 2011. In addition, Mr. Cohen has been

8

Chair of the boardBoard of directorsDirectors of Resource America, Inc. (a publicly-traded specialized asset management company) since 1990 and was its Chief Executive Officer from 1988 until 2004, and President from 2000 until 2003; memberChair of the boardBoard of Resource Capital Corp. (a publicly-traded real estate investment trust that is externally managed by Resource America, Inc.)trust) since its formation in September 2005 and chair of its board from September 2005 until November 2009;2009 and chaircurrently serves on its board; and Chair of the Board of Brandywine Construction & Management, Inc. (a property management company) since 1994. Mr. Cohen is the father of Jonathan Z. Cohen. Mr. Cohen has been active in the energy business for over 30 years. Mr. Cohen’s strong financial

Ellen F. Warren, Founder and energy industry experience, along with his deep knowledgePresident of OutSource Communications

As a member of the Partnership resulting from his long tenure with the PartnershipNational Association of Corporate Directors, Ms. Warren offers expertise in corporate governance matters. Ms. Warren has extensive public relations, corporate communications and its predecessors, enables Mr. Cohenmarketing experience, having founded and led various marketing communications firms and is uniquely positioned to provide valuable perspectives on many issues facing the Partnership. Mr. Cohen’s service on the Board creates an important link between management and the Board and provides the Partnership with decisive and effective leadership. Mr. Cohen’s extensive experience in founding, operating and managing public and private companies of varying size and complexity enables him to provide valuable expertise to the company. Additionally, among the reasons for his appointment as a director, Mr. Cohen bringsleadership to the Board the vast experience that he has accumulated through his activities as a financier, investorin public relations and operator in various parts of the country. These diverse experiences have enabled Mr. Cohen to bring unique perspectivescommunications matters. Ms. Warren brings valuable management, communication, community involvement and leadership skills to the Board, particularly with respect to business management, financial markets and financing transactions and corporate governance issues.Board.

Ellen F.Ms. Warren, 56,57, has served as a director since February 2011. Before that, she was a director of Atlas Energy, Inc. from September 2009 until February 2011. She is founder and President of OutSource Communications, a marketing communications firm that services corporate and nonprofit clients. Prior to founding OutSource Communications in August 2005, she was President of Levy Warren Marketing Media, a public relations and marketing firm she co-founded in March 1998. She was previously Vice President of Marketing/Communications for Jefferson Bank (a Philadelphia-based financial institution) from September 1992 to February 1998, and President of Diversified Advertising, Inc. (an advertising and marketing firm) from December 1984 to September 1992, where she provided marketing services to various industries, including the energy industry. Ms. Warren is a seasoned energy company director having served as an independent member of the board of Atlas Energy Resources, LLC from December 2006 until September 2009, where she chaired a special committee, and later on the board of Atlas Energy, Inc. Ms. Warren serves as Chairchair of the General Partner’s Compensation Committee. As a member of the National Association of Corporate Directors, Ms. Warren offers expertise in corporate governance matters. Ms. Warren has extensive public relations, corporate communications and marketing experience, having founded and led various marketing communications firms and is uniquely positioned to provide leadership to the Board in public relations and communications matters. Ms. Warren brings valuable management, communication, community involvement and leadership skills to the Board.

CONTINUING DIRECTORS

Continuing Directors to ServeServing until the 2015 Annual Meeting:Meeting

Dennis A. Holtz, 72,73, has served as a director since February 2011. Before that, he was a director of Atlas Energy, Inc. from February 2004 to February 2011. Mr. Holtz maintained a corporate and real estate law practice in Philadelphia and New Jersey from 1988 until his retirement in January 2008. During that period, Mr. Holtz was counsel for or corporate secretary of numerous private and public business entities and this extensive

7

experience with corporate governance issues was the reason he was chosen as Chairchair of the Nominating and Governance Committee. As a licensed attorney with 48 years of business experience, Mr. Holtz offers a unique and invaluable perspective into corporate governance matters, as a licensed attorney with 47 years of business experience.matters. Additionally, Mr. Holtz has extensive knowledge of the energy industry, having served as a director of former affiliated companies for nine years.

William G. KarisWalter C. Jones, 64,51, has served as a director since January 2006. Mr. Karis has beenOctober 2013. From April 2010 to October 2013, Ambassador Jones served as the principal of KarisUnited States Executive Director and Associates, LLC (a consulting company that provides financial and consulting servicesChief-of-Mission to the coal industry) since 1997.African Development Bank in Tunis, Tunisia, having been nominated for the position by President Barack Obama in 2009 and confirmed by the United States Senate in 2010. In that position, he represented the United States on the African Development Bank’s Board of Directors, and served as chair of the bank’s audit committee and vice-chair of both the ethics and development effectiveness committees. From June 2005 until May 2007, Ambassador Jones served as the Head of Private Equity and General Counsel at GRAVITAS Capital Advisors, LLC (an independent advisory firm). From May 1994 to May 2005, and then again from September 2007 until April 2010, Ambassador Jones was at the Overseas Private Investment Corporation, where he served as Manager for Asia, Africa, the Middle East, Latin America and the Caribbean, as well as a Senior Investment Officer in the Finance Department. Prior to that, Mr. Karis servedAmbassador Jones was an International Consultant at the Washington, D.C. firm of

9

Neill & Co. Ambassador Jones began his career at the law firm of Sidley & Austin where he was a transactions attorney specializing in various positions at CONSOL Inc. (now CONSOL Energy Company) from 1976 to 1997, culminating in his service as President and CEO from January 1995 to September 1997. Mr. Karisleveraged buyouts. Ambassador Jones is a member of the boards of directorsseasoned energy company director, having previously served as a director and is chair of the audit committee of Atlas Energy Resources, LLC from December 2006 until September 2009 and finance committeesa director of Blue DanubeAtlas Energy, Inc. from September 2009 until March 2010. Ambassador Jones’ combination of private and Greenbrier Minerals, LLC. Mr. Karis has more than 40 years of experience in the energy industry and has acquired a wealth of knowledge regarding the natural resources industry and the challenges and risks it faces. Mr. Karis has extensive knowledge of the Partnership resulting from his seven years of service as a director. Mr. Karis serves as the Chair of our General Partner’s Investment Committee. Mr. Karis also brings valuable management insight in various areas based on hispublic sector experience, as well as his international work, has afforded him a chief executive officer.unique combination of management and leadership experience. In addition, the Board benefits from his investinginvestment and transaction experienceexpertise as well as his energy industry insight andvaluable financial experience.

Harvey G. MagarickJeffrey F. Kupfer, 73,46, has served as a director since March 2014. Mr. Kupfer is currently the Bernard Schwartz Fellow with the Asia Society, a non-profit, non-partisan global institution. He is also an Adjunct Professor of Policy and Management at Carnegie Mellon University’s H. John Heinz III College. From February 2011 to January 2006.2014, Mr. MagarickKupfer served as a senior advisor for policy and government affairs at Chevron and from September 2009 to February 2011, Mr. Kupfer served as a Senior Vice President at Atlas Energy, Inc. Before that, Mr. Kupfer held a number of high level positions in the U.S. Department of Energy. From March 2008 to January 2009, he was the Acting Deputy Secretary and Chief Operating Officer and from October 2006 to March 2008, he was the Chief of Staff. Mr. Kupfer also worked in the White House as a Special Assistant to the President for Economic Policy in 2006, as the Executive Director of the President’s Panel on Federal Tax Reform in 2005, and as Deputy Chief of Staff at the U.S. Treasury Department from 2001 to 2005. Mr. Kupfer brings to the Board extensive experience in the energy industry, as well his perspective as a former senior official in the U.S. government, which the Board views as complementary to the industry perspective of other Board members.

Directors Serving until the 2016 Annual Meeting

Carlton M. Arrendell, 52, has maintained his own consulting practiceserved as a director since June 2004. From 1997February 2011. Mr. Arrendell has been the Chief Investment Officer and a Vice President of Full Spectrum of NY LLC since May 2007. Prior to 2004,joining Full Spectrum, Mr. Magarick wasArrendell served as a partner at BDO Seidman (a national accounting firm).special consultant to the AFL-CIO Investment Trust Corporation following six years of service as Investment Trust Corporation’s Chief Investment Officer. Mr. MagarickArrendell is a memberseasoned energy company director, having previously served as a director of the board of trustees of the HC Capital Trust (an investment fund) and has beenAtlas Energy, Inc. from February 2004 until February 2011 as well as the chair of its audit committee since 2004.from 2004 to 2009. He is also an attorney admitted to practice law in Maryland and the District of Columbia. As a member of the National Association of Corporate Directors and a result of his legal background, Mr. MagarickArrendell offers expertise in corporate governance matters. Mr. Arrendell brings a strong accounting backgroundover 25 years of business experience to the Board, and his investment expertise is valuable to our company and our subsidiaries in evaluating acquisitions being pursued. In addition, the Board benefits from his strong background in finance.

Mark C. Biderman, 68, has served as a “financial expert”director since February 2011. Before that, he was a director of Atlas Energy, Inc. from July 2009 until February 2011. Mr. Biderman was Vice Chair of National Financial Partners Corp. (a publicly-traded financial services company) from September 2008 to December 2008. Before that, from November 1999 to September 2008, he was National Financial’s Executive Vice President and Chief Financial Officer. From May 1987 to October 1999, he served as Managing Director and Head of the Financial Institutions Group at CIBC World Markets Group (an investment banking firm) and its predecessor, Oppenheimer & Co., Inc. Mr. Biderman has served as a director and chair of the audit committee of Full Circle Capital Corporation (a publicly-traded investment company), as well as a member of its corporate governance and nominating committee, since August 2010. Mr. Biderman serves as a director, and chair of the compensation committee of Apollo Commercial Real Estate Finance, Inc. (a publicly-traded commercial real estate finance company) as well as a member of its audit committee, since November 2010. He has also served as a director and chair of the audit committee and as a member of the nominating and corporate governance committee of Apollo Residential Mortgage, Inc. (a publicly-traded residential real estate finance company) since July 2011. Mr. Biderman is a Chartered Financial Analyst. Mr. Biderman brings extensive financial expertise to the Board as well as to the Audit Committee, on which he serves as chair and as a “audit committee financial expert”. Mr. Biderman brings over 40 years’ of business and financial experience to the Board, including his service as a chief financial officer for over eight years. Mr. Biderman also brings more than eight years of collective service

10

on various boards of directors as well as his service on the audit committees of three other companies. In addition, the Board benefits from his business acumen and valuable financial experience.

Jonathan Z. Cohen, 43, has served as the Executive Chair of the Board of our Audit Committee.General Partner since January 2012. Before that, he served as Chair of the Board of our General Partner from February 2011 until January 2012 and as Vice Chair of the Board of our General Partner from its formation in January 2006 until February 2011. Mr. MagarickCohen has served as chair of the executive committee of our General Partner since 2006. Mr. Cohen was the Vice Chair of the Board of Atlas Energy, Inc. from its incorporation in September 2000 until the consummation of the Chevron Merger in February 2011. Mr. Cohen has been the Executive Vice Chair of the managing board of Atlas Pipeline GP since its formation in 1999, and Vice Chair of the Board of Atlas Resource GP since February 2012, both of which are our wholly-owned subsidiaries. Mr. Cohen was the Vice Chair of the Board of Atlas Energy Resources, LLC and its manager, Atlas Energy Management, Inc., from their formation in June 2006 until the consummation of the Chevron Merger. Mr. Cohen has been a senior officer of Resource America, Inc. (a publicly-traded specialized asset management company) since 1998, serving as the Chief Executive Officer since 2004, President since 2003 and a director since 2002. Mr. Cohen has been Chief Executive Officer, President and a director of Resource Capital Corp. since its formation in 2005. Mr. Cohen is a son of Edward E. Cohen. Mr. Cohen’s extensive knowledge of our company resulting from his seven yearslong service with our company and our predecessors, as well as his strong financial and industry experience, allow him to contribute valuable perspectives on many issues facing our company. Mr. Cohen’s service on the Board creates an important link between management and the Board, and provides our company with decisive and effective leadership. Mr. Cohen’s involvement with public and private entities of servicevarying size, complexity and focus, and raising debt and equity for such entities, provides him with extensive experience and contacts that are valuable to our company. Additionally, among the reasons for his appointment as a director. Having serveddirector, Mr. Cohen’s financial, business, operational and energy experience, as well as the experience that he has accumulated through his activities as a partner at BDO Seidmanfinancier and dueinvestor, add strategic vision to his experience as chair of an investment fund’s audit committee for the past eight years,Board to assist with our growth, operations and development. Mr. Magarick has developed a wealth of financial knowledgeCohen is able to draw upon these diverse experiences to provide guidance and leadership with respect to the oversight of (i) the preparation of consolidated financial statements, (ii) internal audit functionsexploration and (iii) public accountants, skills which are critical to our companyproduction operations, capital markets and particularly our audit committee. Mr. Magarick’s accounting experience is critical to understanding the varied issues that face us. In addition, Mr. Magarick’s wealth ofcorporate finance transactions and accounting experience enable him to provide guidance with respect to accounting matters and financing transactions.corporate governance issues.

We have assembled a board of directorsBoard of our General Partner comprised of individuals who bring diverse but complementary skills and experience to oversee our business. Our directors collectively have a strong background in energy, finance, law, marketing, accounting and management. Based upon the experience and attributes of the directors discussed herein, the Board determined that each of the directors should, as of the date hereof, serve on the Board.

NON-DIRECTOR PRINCIPAL OFFICERSNON-DIRECTOR PRINCIPAL OFFICERS

Sean P. McGrath,, 41, 42, has been our Chief Financial Officer of our General Partner since February 2011. Before that he was the Chief Accounting Officer of Atlas Energy, Inc. and the Chief Accounting Officer of Atlas Energy Resources, LLC from December 2008 until February 2011. Mr. McGrath has served as the Chief Financial Officer of Atlas Resource GP since February 2012, and served as the Chief Accounting Officer of our General Partner from January 2006 until November 2009, and as the Chief Accounting Officer of Atlas Pipeline GP from May 2005 until November 2009. Mr. McGrath was the Controller of Sunoco Logistics Partners L.P., a (a publicly-traded partnership that transports, terminals and stores refined products and crude oil,oil) from 2002 to 2005. Mr. McGrath is a Certified Public Accountant.

Matthew A. Jones, 51,52, has been Senior Vice President of our General Partner and President of our exploration and production division since February 2011, and served as Chief Operating Officer of our exploration and production division sincefrom February 2011.2011 until October 2013. Before that, he was the Chief Financial Officer of Atlas Energy, Inc. from March 2005 and an Executive Vice President from October 2009

8

until February 2011. Mr. Jones has been the President and Chief Operating Officer and a director of Atlas Resource Partners GP since March 2012 and its Chief Operating Officer from March 2012 until October 2013, and was the Chief Financial Officer

11

of Atlas Energy Resources, LLC and Atlas Energy Management, Inc. from their formation in June 2006 until the consummation of the Chevron Merger in February 2011. Mr. Jones served as the Chief Financial Officer of our general partnerGeneral Partner from January 2006 until September 2009 and as a member of the Board from February 2006 until February 2011. Mr. Jones was the Chief Financial Officer of Atlas Pipeline GP from March 2005 to September 2009. From 1996 to 2005, Mr. Jones worked in the Investment Banking Group at Friedman Billings Ramsey, concluding as Managing Director. Mr. Jones worked in Friedman Billings Ramsey’s Energy Investment Banking Group from 1999 to 2005. Mr. Jones served as a director of our general partner from February 2006 to February 2011. Mr. Jones is a Chartered Financial Analyst.

Eugene N. Dubay, 64,65, has been our Senior Vice President of Midstream of our General Partner since February 2011. Before that, he was the Chief Executive Officer and President and a director of our general partnerGeneral Partner from February 2009 until February 2011. Mr. Dubay has been President and Chief Executive Officer of Atlas Pipeline GP since January 2009.2009, and was its President from January 2009 until October 2013. Mr. Dubay has served as a member of the managing board of Atlas Pipeline GP since October 2008, where he served as an independent member until his appointment as President and Chief Executive Officer. Mr. Dubay has been the President of Atlas Pipeline Mid-Continent, LLC since January 2009. Mr. Dubay was the Chief Operating Officer of Continental Energy Systems LLC, the parent of SEMCO Energy, from 2002 to January 2009. Mr. Dubay has also held positions with ONEOK, Inc. and Southern Union Company, and has over 20 years ofyears’ experience in midstream assets and utilities operations, strategic acquisitions, regulatory affairs and finance.

Daniel C. Herz, 37, has served as Senior Vice President of Corporate Development and Strategy of our General Partner since February 2011. Before that, he was Senior Vice President of Corporate Development of Atlas Energy, Inc. and Atlas Energy Resources, LLC from August 2007 until February 2011. Mr. Herz has served as Senior Vice President of Corporate Development and Strategy of Atlas Resource GP since March 2012. Mr. Herz has been Senior Vice President of Corporate Development of Atlas Pipeline Partners GP, LLC since August 2007. Before that, Mr. Herz was Vice President of Corporate Development of Atlas Energy, Inc. and Atlas Pipeline Partners GP, LLC from December 2004 and of Atlas Energy’s general partner from January 2006. Prior to joining Atlas Energy, Inc. and Atlas Pipeline Partners GP, LLC, Mr. Herz was an investment banker with Banc of America Securities from 1999 to 2003.

Freddie M. Kotek, 57,58, has been our Senior Vice President of the Investment Partnership Division of our General Partner since February 2011. Before that, he was the Executive Vice President of Atlas Energy, Inc. from February 2004 until February 2011 and served as a director from September 2001 until February 2004. Mr. Kotek has been Senior Vice President of Atlas Resource Partners GP LLC since March 2012, and Chairman of Atlas Resources, LLC since September 2001. He has also served as Chief Executive Officer and President of Atlas Resources LLC since January 2002. Mr. Kotek served as Atlas Energy, Inc.’s Chief Financial Officer from February 2004 until March 2005. Mr. Kotek was a Senior Vice President of Resource America Inc. from 1995 until May 2004 and President of Resource Leasing, Inc. (a wholly-owned subsidiary of Resource America, Inc.)America) from 1995 until May 2004.

Lisa Washington, 45,46, has been our Vice President, Chief Legal Officer and Secretary of our General Partner since February 2011. Ms. Washington has been the Chief Legal Officer and Secretary of Atlas Resource GP since February 2012.2012 and a Senior Vice President since October 2013. Ms. Washington served as Chief Legal Officer and Secretary of our General Partner from January 2006 to October 2009 and as a Senior Vice President of our General Partner from October 2008 to October 2009. Ms. Washington served as Chief Legal Officer and Secretary of Atlas Pipeline GP from November 2005 to October 2009, a Senior Vice President from October 2008 to October 2009 and a Vice President from November 2005 until October 2008. Ms. Washington served as Chief Legal Officer and Secretary of Atlas Energy, Inc., from November 2005 until February 2011, a Senior Vice President from October 2008 until February 2011 andand. a Vice President from November 2005 until October 2008. Ms. Washington served as Chief Legal Officer and Secretary of Atlas Energy Resources, LLC from 2006 until February 2011, a Senior Vice President from July 2008 until February 2011 and a Vice President from 2006 until July 2008. From 1999 to 2005, Ms. Washington was an attorney in the business department of the law firm of Blank Rome LLP.

12

Jeffrey M. Slotterback, 30,31, has been our Chief Accounting Officer of our General Partner since March 2011. Mr. Slotterback has also been the Chief Accounting Officer of Atlas Resource GP since March 2012. Mr. Slotterback served as the Manager of Financial Reporting for Atlas Energy, Inc. from July 2009 until February 2011 and then served as the Manager of Financial Reporting for our General Partner from February 2011 until March 2011. Mr. Slotterback served as Manager of Financial Reporting for both our General Partner and Atlas Pipeline GP from May 2007 until July 2009. Mr. Slotterback was a Senior Auditor at Deloitte and Touche, LLP from 2004 until 2007, where he focused on energy and health care clients. Mr. Slotterback is a Certified Public Accountant.

DIRECTOR COMPENSATION

Our General Partner does not pay additional remuneration to officers or employees who also serve as Board members. In 2013, the annual retainer for non-employee directors was comprised of $75,000 in cash and an annual grant of phantom units with DERs issued under our Long-Term Incentive Plans having a fair market value of $125,000. Chairs of the Nominating and Governance Committee and the Investment Committee receive an additional retainer of $7,500, the chair of the Compensation Committee receives an additional retainer of $10,000 and the chair of the Audit Committee receives an additional retainer of $25,000, which was increased from $15,000 in October 2013.

2013 DIRECTOR COMPENSATION TABLE

9

| Name | Fees earned or paid in cash ($) | Stock awards ($) | All other compensation ($)(1) | Total ($) | ||||||||||||

Carlton M. Arrendell | 75,000 | 124,971 | (2) | 12,581 | 212,552 | |||||||||||

Mark C. Biderman | 84,817 | 124,971 | (2) | 12,581 | 222,369 | |||||||||||

Dennis A. Holtz | 82,500 | 124,971 | (2) | 12,581 | 220,052 | |||||||||||

Walter C. Jones | 14,063 | 124,981 | (3) | 1,190 | 140,233 | |||||||||||

William Karis | 26,291 | — | 44,012 | (4) | 70,303 | |||||||||||

Harvey Magarick | 65,788 | �� | 126,387 | (4) | 192,175 | |||||||||||

Ellen F. Warren | 85,000 | 124,971 | (2) | 12,581 | 222,552 | |||||||||||

| (1) | Represents DERs for phantom units. |

| (2) | For Messrs. Arrendell, Biderman, Holtz and Ms. Warren, represents 3,314 phantom units granted under our 2006 Plan, having a grant date fair value of $37.71. The phantom units vest 25% on the anniversary of the date of grant as follows: 2/17/14—828, 2/17/15—828, 2/17/16—828 and 2/17/17—830. |

| (3) | For Mr. Jones, who joined the Board effective October 24, 2013, represents 2,586 phantom units granted under our 2006 Plan, having a grant date fair value of $48.33. The phantom units vest 25% on the anniversary of the date of grant as follows: 10/24/14—646, 10/24/15—646, 10/24/16—646 and 10/24/17—648. |

| (4) | Messrs. Karis and Magarick, resigned from the Board effective April 25, 2013 and September 24, 2013, respectively, and each received a pro-rated cash equivalent of their annual equity grant amount for 2013. |

PROPOSALProposal 2: ADVISORY VOTE ONAdvisory Vote on

EXECUTIVE COMPENSATIONExecutive Compensation

The Dodd-Frank Wall Street Reform and Consumer ProtectionSection 14A of the Securities Exchange Act enacted in July 2010,of 1934, as amended, requires the Board to provide our unitholders with the opportunity to vote, on a non-binding, advisory basis, on the compensation of our Named Executive Officers (“NEOs”) as set forth in this proxy statement in accordance with the compensation disclosure rules of the SEC. This proposal is also referred to as the Say“Say on PayPay” vote. The first such vote was received by the Partnershipheld at itsour annual meeting in April 2012, at which timewhen a majority of unitholders also voted in favor of the submission of the Say on Pay vote annually. Therefore, the next such Say on Pay advisory vote will occur at our 20142015 annual meeting.

13

At our 20122013 annual meeting, approximately 96%88% of the votes cast approved the 20112012 executive compensation program. The Compensation Committee and the Board believe the results of the Say on Pay vote reflect the Partnership’s unitholders’ affirmation of the executive compensation program.

We urge you to consider the various factors regarding our executive compensation program, policies and practices as detailed under the heading “Compensation Discussion and Analysis.” As discussed at length in the Compensation Discussion and Analysis,that section, we believe that our executive compensation program is competitive and governed by pay-for-performance principles. We emphasize compensation opportunities that reward results. Our use of equity-based incentives reinforces the alignment of the interests of our General Partner’s executives with those of our long-term unitholders. In doing so, our executive compensation program supports our strategic objectives and mission.

This vote is non-binding; however, we highly value the opinions of our unitholders. Accordingly, as in 2012,2013, the Board and the Compensation Committee will take the results of this advisory vote into consideration with respect to future executive compensation decisions.

For the reasons set forth above, the Board unanimously recommends that you vote “FOR” the following resolution:

“RESOLVED, that the compensation paid to the NEOs, as disclosed pursuant to the compensation disclosure rules of the SEC, including the Compensation Discussion and Analysis, compensation tables and narrative discussion, is hereby approved.”

PROPOSALProposal 3: RATIFICATION OF APPOINTMENT OF THERatification of Appointment of the

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRMIndependent Registered Public Accounting Firm

Our independent registered public accountants for the fiscal year ended December 31, 2012 was Grant Thornton LLP. Upon the recommendation of the Audit Committee, approved by the Board, Grant Thornton LLP served as our independent auditors during fiscal year 2012.2013. Grant Thornton LLP has been re-appointed as our independent auditors for fiscal year 2013.2014. Although we are not required to seek unitholder ratification of this appointment, the Audit Committee and the Board believe it to be a matter of good corporate governance to do so. We anticipate that a representative of Grant Thornton LLP will be present at the Meeting, will have the opportunity to make a statement if they desirehe or she desires to do so, and will be available to respond to appropriate questions.

10

For the years ended December 31, 20122013 and 2011,2012, the accounting fees and services (in thousands) charged by Grant Thornton, LLP, our independent auditors, were as follows:

| Years Ended December 31, | Years Ended December 31, | |||||||||||||||

| 2012 | 2011 | 2013 | 2012 | |||||||||||||

Audit fees(1) | $ | 2,822 | $ | 2,286 | $ | 3,159 | $ | 2,822 | ||||||||

Audit-related fees(2) | 174 | 373 | 242 | 174 | ||||||||||||

Tax fees(3) | 183 | 156 | 300 | 183 | ||||||||||||

All other fees | — | — | — | — | ||||||||||||

|

|

|

| |||||||||||||

Total accounting fees and services | $ | 3,179 | $ | 2,815 | $ | 3,701 | $ | 3,179 | ||||||||

|

|

|

| |||||||||||||

| (1) | Represents the aggregate fees recognized in each of the last two years for professional services rendered by Grant Thornton LLP principally for the |

| (2) | Represents the aggregate fees recognized during the |

14

| acquired EP Energy in |

| (3) | The fees for tax services rendered related to tax compliance. |

The Audit Committee, on at least an annual basis, reviews audit and non-audit services performed by Grant Thornton LLP as well as the fees charged by Grant Thornton LLP for such services. Our policy is that all audit and non-audit services must be pre-approved by the Audit Committee. All of such services and fees were pre-approved during 20122013 and 2011.2012.

If our unitholders do not ratify the selection of Grant Thornton LLP, the selection of independent auditors will be reconsidered by the Audit Committee.

The Board unanimously recommends a vote “FOR” the following proposal:

“RESOLVED, that action by the Audit Committee appointing Grant Thornton LLP as the Partnership’s independent registered public accounting firm to conduct the annual audit of the financial statements of the Partnership and its subsidiaries for the fiscal year ending December 31, 2013,2014 is hereby ratified, confirmed and approved.”

GOVERNANCE MATTERSGovernance Matters

General BackgroundGENERAL BACKGROUND

TheOur General Partner manages our operations and activities on our behalf. The Partnership Agreement provides that an annual meeting of the limited partners for the election of directors to the Board and other matters that the Board submits to a vote of the limited partners will be held at such date and time as may be fixed from time to time by the General Partner. At each annual meeting, the limited partners entitled to vote thereon will vote as a single class for the election of directors to the Board, and the limited partners entitled to vote thereon will elect, by a plurality of the votes cast at such meeting, persons to serve on the Board who are nominated in accordance with the provisions of the Partnership Agreement.

11

The BoardTHE BOARD

The Board currently has eight members designated as follows:

Dennis A. Holtz – Class I;

William G. KarisWalter C. Jones – Class I;

Harvey G. MagarickJeffrey F. Kupfer – Class I ;I;

Carlton M. Arrendell – Class II;

Mark C. Biderman – Class II;

Jonathan Z. Cohen – Class II;

Edward E. Cohen – Class III; and

Ellen F. Warren – Class IIIIII.

Board Leadership

Jonathan Z. Cohen serves as the Executive Chairman of the Board and Edward E. Cohen serves as the Chief Executive Officer and President of our General Partner. The Board believes that the most effective leadership

15

structure at the present time is for separation of theto have separate Executive Chairman of the Board from the Chief Executive Officer position.positions because it benefits from having two strong voices bringing separate views and perspectives to its considerations. The Chief Executive Officer and the Executive Chairman of the Board are in constant contact and serve together as theour executive committee of the Partnership.committee.

Director Independence

The NYSE rules do not require the boards of directors of publicly traded limited partnerships to be made up of a majority of independent directors. However, with the exception of Messrs. E. Cohen and J. Cohen, all of our directors are independent and meet the independence requirements of the NYSE. To be considered an independent director under the NYSE listing standards, the Board must affirmatively determine, after recommendation by the Nominating and Governance Committee and after due deliberation, that a director has no material relationship with us. In making this determination, the Board: (i) adheres to all of the specific tests for independence included in the NYSE listing standards, and (ii) considers all other facts and circumstances it deems necessary or advisable and any standards of independence as may be established by the Board from time to time. The Board previouslyhas determined and has affirmed that the following members of the Board are independent: Mr. Arrendell, Mr. Biderman, Mr. Holtz, Mr. Karis,Jones, Mr. MagarickKupfer and Ms. Warren.

Meetings of the Board

During the year ended December 31, 2012,2013, the Board had 1012 regularly scheduled and special meetings. There was 100% attendance at the meetings of the Board and its committees except for twofour Board meetings in which seven of the eight directors attended.

Attendance at Annual Meetings

The Board does not have a policy with respect to Board members’ attendance at annual meetings. All of the directors attended last year’s annual meeting of unitholders, and we anticipate that all of them will attend the Meeting.

Unitholder Communications with the Board

Interested parties wishing to communicate directly with the non-management directors may contact the chairman of the Audit Committee, Harvey Magarick.Mark C. Biderman. Correspondence to Mr. MagarickBiderman should be marked “Confidential” and sent to Mr. Magarick’sBiderman’s attention, c/o Atlas Energy, L.P., 1845 Walnut Street, 10th Floor, Philadelphia, PA 19103.

12

Role in Risk OversightROLEIN RISK OVERSIGHT

General

The Board’s role in risk oversight recognizes the multifaceted nature of risk management. The Board has empowered several Board committees with aspects of risk oversight. We administer our risk oversight function through our Audit Committee and the Atlas Resource Partners, L.P. (“ARP”) and Atlas Pipeline Partners, L.P.’s (“APL”)APL environmental, health and safety committees. The Audit Committee monitors material enterprise risks and, in order to assist in its oversight function, it oversaw the creation of the enterprise risk management committee consisting of senior officers from our various divisions that are responsible for day-to-day risk oversight. It meets with the members of the enterprise risk management committee as needed to discuss our risk management framework and related areas. The Audit Committee also reviews any major transactions or decisions affecting our risk profile or exposure, and reviews with counsel legal compliance and legal matters that could have a significant impact on our financial statements. Our Audit Committee also oversees our internal audit function, and is responsible for monitoring the integrity and ensuring the transparency of our financial reporting processes and systems of internal controls

16

regarding finance, accounting and regulatory compliance. The Audit Committee incorporates its risk oversight function into its regular reports to the Board. The environmental, health and safety committees of ARP and APL assist in determining whether appropriate policies and management systems are in place with respect to environment, health and safety and related matters and monitor and review compliance with applicable environmental, health and safety laws, rules and regulations. Our subsidiaries’ environmental, health and safety committees review actions taken by management with respect to deficiencies identified or improvements recommended.

In addition to our Audit Committee and subsidiaries’ environmental, health and safety committees’ role in overseeing risk management, our full Board regularly engages in discussions of the most significant risks that we face and how these risks are being managed. Our General Partner’s senior executives provide the Board and its committees with regular updates about our strategies and objectives, and the risks inherent withinwith them, at Board and committee meetings and in regular reports. Board and committee meetings also provide a venue for directors to discuss issues of concern with management. The Board and committees call special meetings when necessary to address specific issues or matters that should be addressed before the next regularly scheduled meeting. In addition, our directors have access to our management at all levels to discuss any matters of interest, including those related to risk. Those members of management most knowledgeable of the issues attend Board meetings to provide additional insight into items being discussed, including risk exposures.

Compensation Programs

Our compensation policies and programs are intended to encourage our employees to remain focused on both our short-term and long-term goals. For example, our equity awards often vest 25% on the third anniversary and 75% on the fourth anniversary of the date of grant.over a three or four year period. We believe this practice encourages our employees to focus on sustained unit price appreciation, thus limiting the potential of our executives to engage in excessive risk-taking. Annual incentives are intended to tie a significant portion of each of the NEO’s compensation to our annual performance and/or that of the subsidiaries or divisions for which the officer is responsible. We believe that our focus on revenue growth and distributable cash flow in making incentive bonus awards and unit price performance in granting equity awards provides a check on excessive risk-taking. In addition, our Clawback Policy allows us to recoup any excess incentive compensation paid to our NEOs if the financial results on which the awards were based are materially restated due to fraud, illegal or intentional misconduct or gross negligence of the executive officer. Our Code of Business Conduct and Ethics, which applies to all officers and directors, further seeks to mitigate the potential for inappropriate risk-taking. We also prohibit hedging transactions involving our units so our officers and directors cannot insulate themselves from the effects of our unit price performance.

The Compensation Committee, together with senior management, also reviews compensation programs and benefits plans affecting employees generally (in addition to those applicable to our executive officers), and we have concluded that our compensation policies and practices do not create risks that are reasonably likely to have a material adverse effect on theour company. We also believe that our incentive compensation arrangements provide incentives that do not encourage risk-taking beyond our ability to effectively identify and manage significant

13

risks; are compatible with effective internal controls and our risk management practices; and are supported by the oversight and administration of the Compensation Committee with regard to executive compensation programs.

Board CommitteesBOARD COMMITTEES

The Board has four standing committees:

Audit Committee.The principal functions of the Audit Committee are to assist the Board in monitoring the integrity of our financial statements, the independent auditor’s qualifications and independence, the performance of our independent auditors and our compliance with legal and regulatory requirements. The Audit Committee reviews the scope and effectiveness of audits by the independent accountants, is responsible for the engagement of independent accountants and reviews the adequacy of our internal controls. The Audit Committee held six

17

10 meetings during fiscal 2012.2013. All of the members of the Audit Committee are independent directors as defined by NYSE rules. The members of the Audit Committeeaudit committee are Mr. Karis,Biderman, Mr. BidermanArrendell and Mr. Magarick,Jones, with Mr. MagarickBiderman acting as the chairman. The Board has determined that Mr. MagarickBiderman is an “audit committee financial expert,” as defined by SEC rules. Prior to Mr. Magarick’s resignation from the Board in April 2013, he served as chair of the Audit Committee as well as the “audit committee financial expert.” Mr. Biderman serves on the audit committees of three other public companies, two of which are affiliates of each other. The Board has determined that Mr. Biderman’s simultaneous service on these other audit committees will not impair his ability to serve effectively on the Audit Committee. The Board previously adopted a written charter for the Audit Committee, a current copy of which is available on our web site atwww.atlasenergy.com.

Compensation Committee.The principal functions of the Compensation Committee are to assist the Board in carrying out its responsibilities with respect to compensation. In particular, the Compensation Committee evaluates the compensation paid or payable to the chief executive officer and other named executive officers of our General Partner. The Compensation Committee reviews compensation paid or payable under employee qualified benefit plans, employee stock option and restricted stock option plans, under individual employment agreements, and executive compensation and bonus programs. The Compensation Committee held eight10 meetings during fiscal 2012.2013. The Compensation Committee is comprised solely of independent directors, consisting of Ms. Warren and Messrs. Arrendell and Holtz, with Ms. Warren acting as the chairperson. The Board previously adopted a written charter for the Compensation Committee, a current copy of which is available on our web site atwww.atlasenergy.com.

Investment CommitteeCommittee.. The principal functions of the Investment Committee are to assist the Board in reviewing management investment practices, policies, strategies, transactions and performance, as well as evaluating and monitoring existing and proposed investments. The Investment Committee held fourthree meetings during fiscal 2012.2013. All of the members of the Investment Committee are independent directors as defined by NYSE rules. The members of the Investment Committee are Messrs. Biderman, KarisJones and Magarick,Kupfer, with Mr. KarisBiderman acting as the chairman. The Board previously adopted a written charter for the Investment Committee.

Nominating and Governance Committee.The principal functions of the Nominating and Governance Committee are to recommend persons to be selected by the Board as nominees for election as directors, recommend persons to be elected to fill any vacancies on the Board, consider and recommend to the Board qualifications for the office of director and policies concerning the term of office of directors and the composition of the Board and consider and recommend to the Board other actions relating to corporate governance. The Nominating and Governance Committee held fivefour meetings during fiscal 2012.2013. The Nominating and Governance Committee is comprised solely of independent directors, consisting of Ms. Warren and Messrs. Arrendell and Holtz, with Mr. Holtz acting as the chairman. The Board previously adopted a written charter for the Nominating and Governance Committee, a current copy of which is available on our web site atwww.atlasenergy.com.

The Nominating and Governance Committee will consider nominees recommended by unitholders for the 20142015 annual meeting if submitted in writing to our Secretary in accordance with rules promulgated by the SEC and the Partnership Agreement. See “—“Proposal I: Director Nominations”Nominations—Director Nomination Process” and “Unitholder Proposals andor Director Nominations.”

14

Director Nominations